Advantages and Disadvantages of Letter of Credit in Global Trade

A letter of credit provides a financial backdrop to both the buyers/importers and overseas suppliers ie. sellers/exporters in cross-border trade transactions by ensuring that the payment will be made on time.

Before using an international letter of credit, it is important to consider its advantages and disadvantages. Let’s find it in detail:

What is a Letter of Credit?

A letter of credit is a legal document issued by a bank or a private institution guaranteeing that a buyer will pay the seller on time and for the correct amount of goods & services ordered. In the event, that the buyer defaults or is unable to pay, the issuing bank will compensate the full or remaining amount to the seller.It is one of the most & frequently used trade finance service in cross-border trade transactions used by sellers and buyers to avoid payment failure while importing and exporting. It is a highly customizable and effective form that can reduce credit risks. Let’s see how it works.

How Does International Letter Of Credit Services Work?

A letter of credit process involves at least three basic parties ie. buyer, seller, and letter of credit service providers ie. an issuing financial institution.The process starts with the buyer applying to the bank they have an established relationship with instead of applying to a new bank. The buyer fills & submits an application to his issuing bank regarding availing international letter of credit services and requests to issue an LC in the favor of his supplier ie. seller.

At the conclusion of the transaction, if the buyer doesn’t pay as promised, the seller is required to present relevant documents to the issuing bank. If the conditions are met, the bank must pay the due amount.

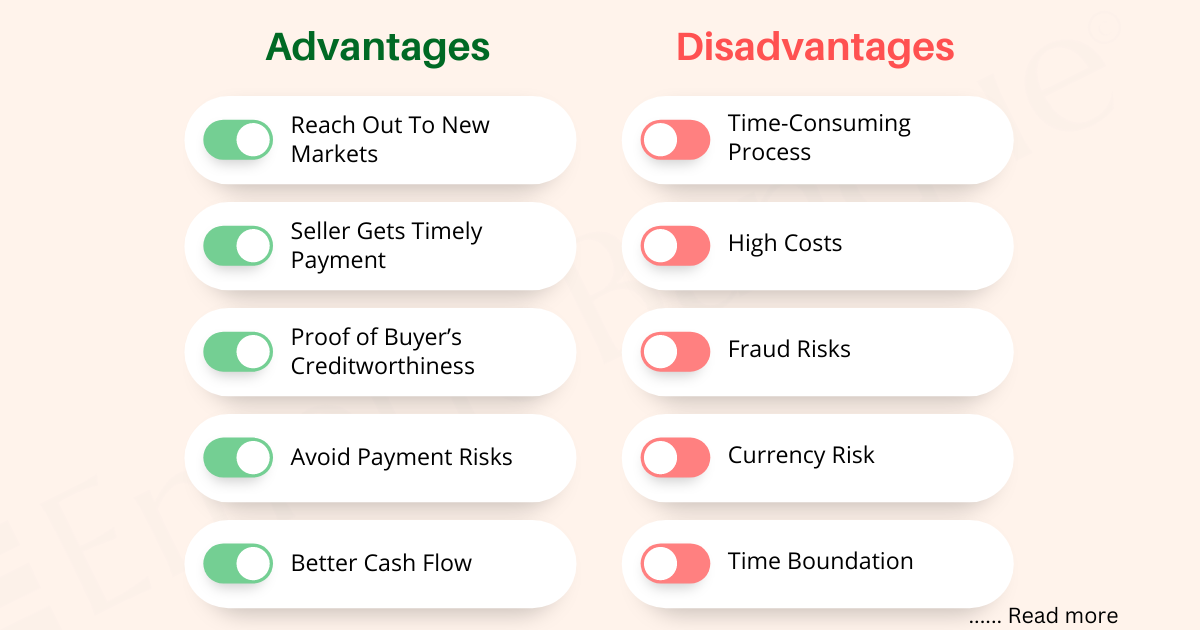

Advantages of Letter of Credit

An issuance of LC has a variety of advantages for both the importers & exporters. Some of them are as follows:1. Reach Out To New Markets

A letter of credit and standby letter of credit gives trade parties the ability to find & transact with new/unknown customers residing overseas. Establishing a new business isn’t easy for the sellers as no buyer agrees to make an advance payment to an unknown seller. With a letter of credit, the exporter can get involved in new trade relationships.2. Highly Customizable

An LC import finance can be customized according to the requirements and needs of the parties involved. In other words, both the importers & exporters can put their terms & conditions in the LC agreement they both agree on and arrive at a mutual list of clauses.3. Seller Gets Timely Payment

Another benefit of these trade finance services is that the sellers are assured of getting an on-time payment from their overseas buyers for the ordered goods. Since it involves a legal authority ie. an issuing bank to eliminate the failure of payment and provide financial security, the sellers get peace of mind.4. Proof of Buyer’s Creditworthiness

In a letter of credit and bank guarantee, the buyer’s financial burden to pay is shifted to the issuing bank. It enables the sellers to execute multiple transactions with the buyer as there is a financially capable & legal authority in the background.5. Seller is Free from Credit Risks

Knowing the advantages and disadvantages of LC while executing a global trade transaction helps the importers-exporters avoid future complexities. Since the creditworthiness of the importer is shifted to the bank, an LC export finance is recommended for the seller if the buyer goes bankrupt as the payment will be made by the bank.6. Avoid Payment Risks In Disputable Transactions

In the case of a dispute between the importers-exporters, the exporters can withdraw the funds in accordance with the terms & conditions mentioned in the LC agreement and resolve the dispute later in court. However, the importer has no right to deny or hold the payment to the exporters by raising objections on the quality of goods.7. Better Cash Flow

The international letter of credit services provides security of the payment to the exporters so they can finance the production of ordered goods and initiate supply on time.8. Timely Shipments

The exporters can apply for pre-shipment financing against a letter of credit ie. an advance payment before the shipment of goods to the buyers.Disadvantages of Letter of Credit

A letter of credit has some disadvantages too as listed below:

1. Time-Consuming Process

A letter of credit is conditional formatting. The required documentation and formalities in the process are not easy and take too much time.2. High Costs

To avail of a confirmed letter of credit, exporters may pay high fees to the banks. It can increase additional costs for them.3. Fraud Risks

The issuance of an LC has a variety of complex governing rules and some buyers or sellers can misuse it to take advantage of it. A letter of credit implies fraud risks to the importer. The bank is supposed to pay the exporter after reviewing the shipping documents, not the actual quality of the goods.4. Currency Risk

Another disadvantage of letter of credit is that it also carries foreign currency fluctuation risks. Though one of these trade parties will have a different currency than others, they will always face currency risk fluctuations.5. Time Boundation

A letter of credit is made with an expiration date, which imposes a time limit on the exporters to deliver the goods in a particular time frame.6. Risk of Default by Issuing Bank

Though an LC transfers the creditworthiness from the buyers to the issuing bank, so if the issuing bank defaults, there is a risk of payment failure to the exporters.Conclusion

LC is a complex trade finance instrument to secure the importers-exporters from payment failure and other cross-border trade transaction risks such as currency fluctuations or political instability etc. It is vital to get aware of the advantages and disadvantages of Letter of Credit before using them.